However under section 267 2 of the Companies Act 2016 the Registrar of Companies can. The mandatory audit requirement is perceived to better improve the business potential for audit firms that primarily service the private limited companies in Malaysia.

Audit Exemption For Private Companies Venture Haven Top Malaysia Accounting Firm

Audit exemption was influenced by audit benefits and.

. It does not have any revenue during the current financial year. PERCEPTIONS OF MALAYSIAN AUDITORS Hasnah Haron1 Ishak Ismail2 Yuvaraj Ganesan3 and Zulhawati4 12 Faculty of Industrial Management Universiti Malaysia Pahang 26300 Gambang Pahang M al ysi. Heres the list of criteria to qualify for audit exemptions for private companies in Singapore at least 2 out of 3 criteria for the immediate past 2 consecutive.

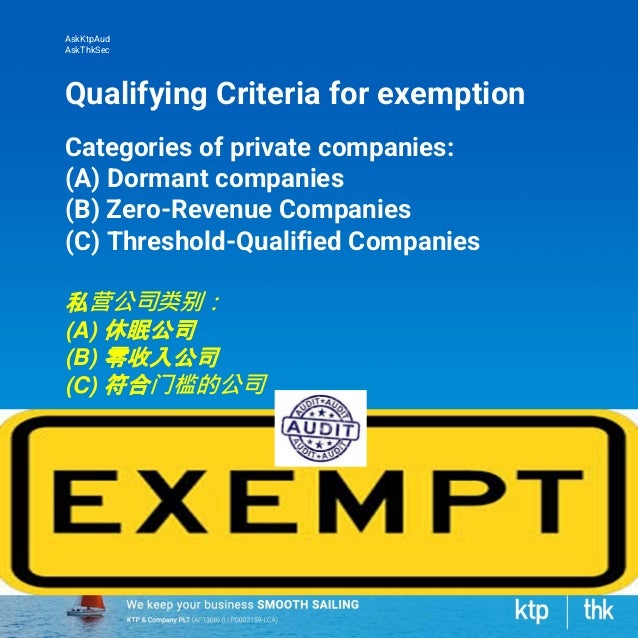

How to qualify for Audit Exemption in Malaysia. B Its total assets in the current Statement of Financial Position does not exceed RM300000 and in the immediate past two financial years. B Zero-revenue companies Audit Exemption.

The hypotheses in this study were developed to examine whether the level of acceptance on. A private company which falls within the following categories may opt for Audit Exemption. What are the limits for exemption in Malaysia.

The Companies Commission of Malaysia SSM today issues a Practice Directive highlighting the categories of private companies that qualify for audit exemption. Audit exemption of Malaysia Private Companies. To further reduce the cost of doing business the Companies Commission of Malaysia has announced that dormant zero-revenue and threshold-qualified private companies are eligible to elect for audit exemption.

A zero-revenue company is a private entity as defined by the MASB and the company is qualified for audit exemption if. On 4 August 2017 the Companies Commission of Malaysia SSM brought into action audit exemption for certain categories of private companies. What is the threshold for company audit exemption.

1 AUDIT EXEMPTION FOR SMALL AND MEDIUM ENTERPRISES. This article is based on Proposed Practice Directive 12017 on Audit Exemption issued by CCMSSM on 8 November 2016. Just be mindful that if you are in year 2017 you will normally be preparing the audited report for financial year 2016.

And c It has at the end of its current. Written by Gunalan Appalasamy CA M It was proposed that Dormant Companies. The Companies Act 2016 which came into operation on 31 January 2017 requires all companies to prepare and audit their financial statements before lodging it with the Companies Commission of Malaysia SSM.

Audit Exemption For Certain Categories Of Private Companies. 4Faculty of Information Technology and. It does not have any revenue in the immediate past two 2 financial years.

On 4 August 2017 the Companies Commission of Malaysia SSM brought into effect audit exemption for certain categories of private companies. 我的 Sdn Bhd Account 要怎样不需审计 How can I be exempt from audit. On 4 August 2017 the Registrar of Companies in Malaysia CCM or the Registrar issued a practice directive setting out the qualifying criteria for private companies incorporated in Malaysia from having to appoint an auditor in a financial year Practice Directive.

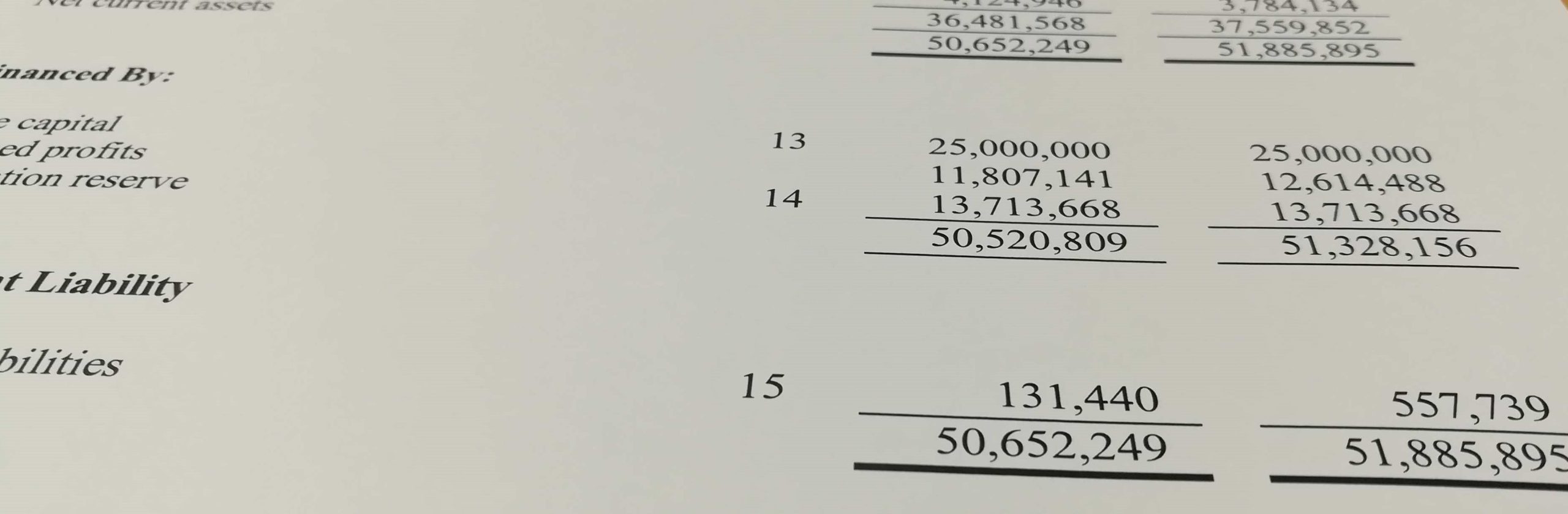

10the company is qualified for audit exemption if a It has revenue not exceeding RM100000 during the current financial year and in the immediate past two financial years. Audit Exemption for Private Companies. Companies opting for audit exemption must provide a complete collection of unaudited.

3 School of M angem nt Universiti ins M l ysia 11800 P si. A zero-revenue company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is qualified for audit exemption if. An auditor shall not be required to be appointed in order to prepare and audit financial statements if the company fulfil the criteria given.

The Companies Commission of Malaysia has issued Practice Directive No. How do I file an exemption for an audit. 32017 to set out the qualifying criteria for private companies to be exempted from appointing an auditor for a financial year.

Companies that satisfy the criteria set forth shall not be required to appoint an approved auditor to prepare and audit their financial statements before lodging. However as for the private limited companies the audit fee is a financial burden to. Although in general all companies are required to prepare and audit the financial statements the Companies Act 2016 empowers the Registrar to exempt.

Get professional audit services in Malaysia from our qualified auditors. Audit Exemption For Selected Categories Of Private Companies. Its total assets in the current Statement of Financial Position FS does not exceed.

It does not have any revenue during the current financial year. Malaysia company audit exemption has been the focus of wide debate and contemplation over the years. Contact us now Malaysia Audit V2 Intern4 2022-07-07T1543570800.

Full story in our blog httpslnkdingakwpeXm Read our past Facebook posting on How can I. On August 4 2017 the Companies Commission of Malaysia CCM has brought into force audit exemption for certain categories of private companies. It does not have any revenue in the immediate past two financial years.

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Pdf The Provision Of Non Audit Services Audit Fees And Auditor Independence Semantic Scholar

Audit Exemption For Private Companies Sierra

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Audit Assurance Hills Cheryl Corporate Advisory Sdn Bhd

Malaysia Ccm Issues Practice Directive On Audit Exemptions For Private Companies Conventus Law

Pin By Islamic Relief Malaysia Irm On Covid 19 Emergency Appeal Emergency Map Covid 19

Audit Exemption For Private Companies Sierra

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Simbolo De Libra Como Economizar Dinheiro Graficos Financeiros

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Company Audit Ceiling Limit Under The Companies Act 2013 Ebizfiling

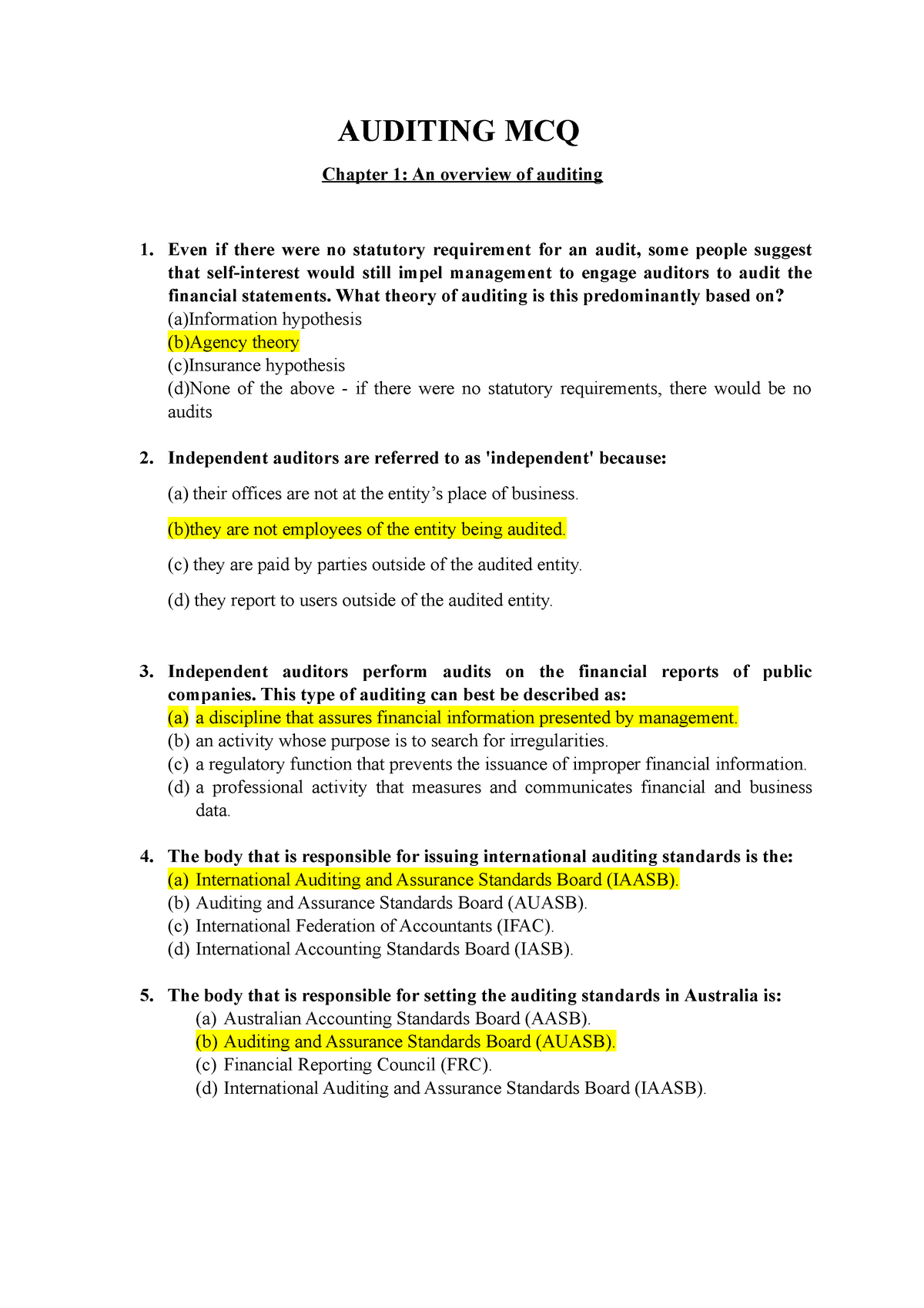

Auditing Mcq Aar Mcq Auditing Mcq Chapter 1 An Overview Of Auditing 1 Even If There Were No Studocu

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Mariels I Will Help You Process An Irs Tax Letter Notices Or Audits For 20 On Fiverr Com Irs Taxes Tax Consulting Business Tax

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Pdf Audit Exemption For Small And Medium Enterprise Perceptions Of Malaysian Auditors